In the previous week, boosted by India’s Oct-Dec GDP growth rate number at 8.4% that was much ahead of estimates, the sensex on Saturday (in a special sessions) closed just a tad off the 74K mark, at 73,806 points, while Nifty was at 22,378 points.Both the indices are in uncharted territory now.

A host of global and local factors are expected to decide the market’s trend, brokers and analysts said, although there are no major events scheduled for the week. “In the absence of any major event, participants will continue to take cues from the global indices,” said Ajit Mishra of Religare Broking.

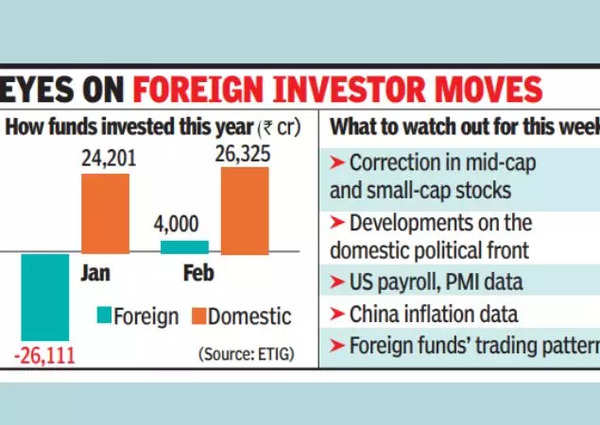

“While the US markets have been moving gradually higher with every passing week, the tech-heavy index, Nasdaq Composite, has finally reclaimed its record high after over two years and that may provide the needed trigger for an up move in IT counters (in the Indian market) also.” On the domestic front, developments on the political front in the build up to the elections in April-May would also have some impact on market sentiment, dealers said.

There could be some pressure on mid and small-cap stocks after Sebi, though mutual fund industry trade body Amfi has asked fund houses to look at probable pain points in case of a sudden and sharp slide in these stocks and their impact on retail investors.

In a year, BSE’s small cap index has gained 65% while the mid cap index is up 63%. In comparison, the corresponding numbers for the sensex and Nifty are 24% and 28%, respectively. “Correction in mid and small-cap stocks is underway and is expected to continue, with regulators urging disclosure of associated risks by (mutual funds),” said Vinod Nair of Geojit Financial Services.

Market players on Dalal Street would also be looking at some key economic data from across the world. These include payroll data from the US, inflation data from China and also American manufacturing data, they said.

IPO Calendar

In the primary market, three main board IPOs, along with five primary offers in the SME segment, are set to open. Together these offers are eyeing to mobilise close to Rs 1,500 crore from the market.

The Rs 650-crore Gopal Snacks will open on March 6 and close on March 11. Ahead of this offer, the Rs 424-crore IPO for R K Swamy, the first integrated marketing company eyeing to list in India, will open on March 4 and close on March 6. The other main board IPO would be of JG Chemicals that’s eyeing to raise Rs 251 crore and will remain open from March 5 to March 7.