Equity markets were also rife with rumours about Mukesh Ambani’s Jio Financial Services taking over Paytm’s operations, leading to the shares hitting an all-time high intraday and closing 14% higher at Rs 289. In a late evening clarification to exchanges, Jio Financial Services said “the news item is speculative and we have not been in any negotiations in this regard”.

Paytm is understood to be in talks with banks to move merchant accounts that are linked to QR codes. However, bankers said there is no regulatory clarity on whether there can be such a one-time shift of accounts without fresh KYC. PhonePe is reaching out to shopkeepers with special deals on payment acceptance devices. Google Pay has also increased feet on street to acquire merchants.

Fintech startup Slice has rolled out its UPI first account to the broader public on Monday — it will offer users a UPI handle and a virtual account. “The whole Paytm situation opens up opportunities for other players. The idea is to capitalise on it,” a fintech executive said. HDFC Bank is also looking to boost its QR code merchant base. Earlier, this business was seen as unprofitable because of the absence of merchant fees. Now, the war for deposits is prompting banks to look at this segment, which they had lost to fintechs.

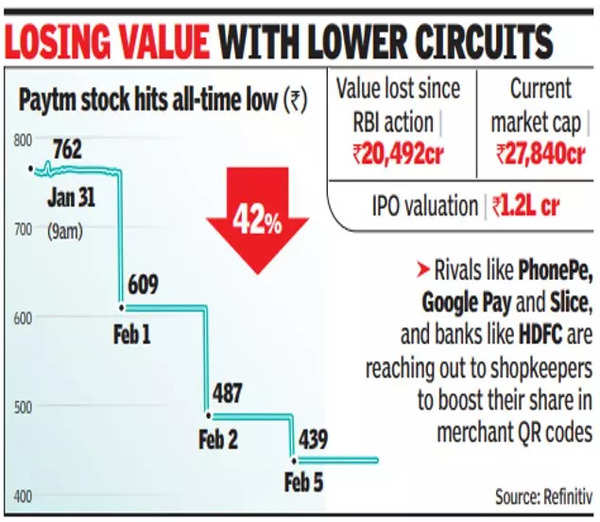

The stock price of Paytm operator One 97 Communications hit an all-time low of Rs 439 on the BSE, down nearly 80% from its IPO price. The company continued to engage in firefighting and denied reports of the company and its associate Paytm Payments Bank being investigated for violation of foreign exchange rules. The stock shed over 42% in the first three trading sessions of February following RBI’s move to ban Paytm Payments Bank from accepting fresh deposits after Feb 29.

Paytm founder and CEO Vijay Shekhar Sharma assured customers of the app’s safety and operational continuity. However, there is no clarity on what services the payments bank can offer from March 1.

“Paytm is a brand of deep value. Its value depth is a big multiple of its actual transactional value in terms of turnover and profit. The RBI diktat hurts the brand badly. A brand is essentially a reputation. This reputation is stirred, if not shaken,” business and brand strategy specialist Harish Bijoor said.